Execution Strategy and Business Strategy

Rebecca Frankel shared on her Google Reader Feed this image:

I think it's a great example of execution strategy. A frequently used execution strategy is to standardize on one platform and optimize on delivery that way. The nice thing about this strategy is that if you're the startup and the incumbent has built in legacy systems and costs that keep them from executing on the same strategy, you'll have a built-in advantage that will continue for a good long time. For instance, it's hard for an airline to switch the hubs it's using after it's been locked into a long term contract. And obviously, it's hard for incumbent airlines to sell all their fleets and standardize on the 737. The strategy that RyanAir uses, by the way, was first pioneered by SouthWest Airlines. A good execution strategy like this can be easily explained to all your employees to the point where everyone knows what the strategy is, leading to broader alignment.

At Google circa 2003, the execution strategy was straight-forward: build clusters of commodity machines driven by a common software infrastructure so scaling was straightforward. Once MapReduce was adopted, for instance, your mapreduce jobs were datacenter independent and could be run on any number of datacenters. Similarly, all projects could share a single set of site reliability engineers, release engineers, etc., and your resource constraints could be relieved by effectively hiring in all these areas.

The problem comes when you have a new product that doesn't fit your existing execution strategy. Orkut, for instance, was initially written using Microsoft's .NET framework. That didn't fit in with what the rest of Google was doing. It rapidly became a popular product, and the system started falling over from the huge number of requests. The team was staff-constrained, and few engineers inside Google wanted to work on a product that was clearly way out on the left field with respect to Google's execution strategy. To be honest, nobody knew how big social networks were going to be. The result was that it took a while to rewrite Orkut to conform with Google's execution strategy, and by the time it was done enough time had passed and enough users had migrated to another social network that the rest was history. In retrospect, the right thing to do should have been to spin Orkut off, have it raise its own funding round (with Google kicking money), and race quickly to deal with its scaling problems independent of the rest of Google's infrastructure. Facebook might still have won, but at least Orkut wouldn't have been paying Google's strategy tax. Microsoft has its own strategy tax here in that everything has to be tied to windows, but I think even Microsoft's starting to move away from that with its phone and tablet entries.

Business strategy is a whole different animal. In some ways, it's like playing a strategic board game with your business. I'll give you an example. Microsoft invested $240M in Facebook in 2007 at the then stunning valuation of $15B. At that time, Facebook was not profitable (and would become profitable based on Microsoft's guaranteed revenue), and it looked like Microsoft was desperate, throwing money at Facebook. Well, 4 years later, it looks like a brilliant move. Not only does it look like Microsoft's investment will pay off (at least 4X, maybe more), Facebook's been a tremendous thorn on Google's side, probably accounting for no small amount of management distraction, time spent launching (and re-launching) competitive products, and I'm sure no small drain on Google's engineering team. Time will tell as to whether Microsoft's acquisition of Nortel's patent portfolio, essentially forcing Google to buy Motorola will be similarly smart, but spending $4.5B (and that's split between Apple/RIM/Sony/EMC, etc) so that your competition has to spend $12.5B (and ends up having to run a hardware business that's not particularly profitable --- Motorola's the weakest of the Android manufacturers) looks pretty smart right now.

Another company which is good at this is Amazon. The Kindle, for instance, unusually attacked the market from a completely different angle. It's early adopters were not the usual hip 20-somethings, but were the older generation: people who still read and whose deteriorating eye-sight and arthritis made the Kindle an almost must-have. This was so much ignored by other vendors (Apple included) that by the time other ebook stores launched, nobody else has made a dent in electronic book distribution. By ensuring that the Kindle App is available for nearly every platform, Amazon has gotten a choke-hold on electronic book distribution that's only starting to be realized at this point.

Someone told me a little bit back that Amazon's S3 services were priced at below cost at launch. Basically, they bet that they could drive costs down a bit, and that customers would see the move to their cloud services as a no-brainer at those prices and thereby gain them further economies of scale. At this point, I've run into lots of companies that have based their businesses on S3, but comparatively few who've done so on Google's AppEngine infrastructure AppEngine is a bit of a red-headed stepchild at Google because it can't be priced to produce high margins, while Amazon's very much used to low margins.

Obviously, business strategy is of no use if you screw up your execution strategy (or if your product sucks --- nothing ever saves you then), but ideally you want everything in place. Amazon's been the stealth surprise in the past few years in places that looked completely unrelated to e-commerce because of this. At the same time, Microsoft's not being doing so well at execution but its business strategy successes are being ignored by the press, and I think that counting them out would be a mistake.

I think it's a great example of execution strategy. A frequently used execution strategy is to standardize on one platform and optimize on delivery that way. The nice thing about this strategy is that if you're the startup and the incumbent has built in legacy systems and costs that keep them from executing on the same strategy, you'll have a built-in advantage that will continue for a good long time. For instance, it's hard for an airline to switch the hubs it's using after it's been locked into a long term contract. And obviously, it's hard for incumbent airlines to sell all their fleets and standardize on the 737. The strategy that RyanAir uses, by the way, was first pioneered by SouthWest Airlines. A good execution strategy like this can be easily explained to all your employees to the point where everyone knows what the strategy is, leading to broader alignment.

At Google circa 2003, the execution strategy was straight-forward: build clusters of commodity machines driven by a common software infrastructure so scaling was straightforward. Once MapReduce was adopted, for instance, your mapreduce jobs were datacenter independent and could be run on any number of datacenters. Similarly, all projects could share a single set of site reliability engineers, release engineers, etc., and your resource constraints could be relieved by effectively hiring in all these areas.

The problem comes when you have a new product that doesn't fit your existing execution strategy. Orkut, for instance, was initially written using Microsoft's .NET framework. That didn't fit in with what the rest of Google was doing. It rapidly became a popular product, and the system started falling over from the huge number of requests. The team was staff-constrained, and few engineers inside Google wanted to work on a product that was clearly way out on the left field with respect to Google's execution strategy. To be honest, nobody knew how big social networks were going to be. The result was that it took a while to rewrite Orkut to conform with Google's execution strategy, and by the time it was done enough time had passed and enough users had migrated to another social network that the rest was history. In retrospect, the right thing to do should have been to spin Orkut off, have it raise its own funding round (with Google kicking money), and race quickly to deal with its scaling problems independent of the rest of Google's infrastructure. Facebook might still have won, but at least Orkut wouldn't have been paying Google's strategy tax. Microsoft has its own strategy tax here in that everything has to be tied to windows, but I think even Microsoft's starting to move away from that with its phone and tablet entries.

Business strategy is a whole different animal. In some ways, it's like playing a strategic board game with your business. I'll give you an example. Microsoft invested $240M in Facebook in 2007 at the then stunning valuation of $15B. At that time, Facebook was not profitable (and would become profitable based on Microsoft's guaranteed revenue), and it looked like Microsoft was desperate, throwing money at Facebook. Well, 4 years later, it looks like a brilliant move. Not only does it look like Microsoft's investment will pay off (at least 4X, maybe more), Facebook's been a tremendous thorn on Google's side, probably accounting for no small amount of management distraction, time spent launching (and re-launching) competitive products, and I'm sure no small drain on Google's engineering team. Time will tell as to whether Microsoft's acquisition of Nortel's patent portfolio, essentially forcing Google to buy Motorola will be similarly smart, but spending $4.5B (and that's split between Apple/RIM/Sony/EMC, etc) so that your competition has to spend $12.5B (and ends up having to run a hardware business that's not particularly profitable --- Motorola's the weakest of the Android manufacturers) looks pretty smart right now.

Another company which is good at this is Amazon. The Kindle, for instance, unusually attacked the market from a completely different angle. It's early adopters were not the usual hip 20-somethings, but were the older generation: people who still read and whose deteriorating eye-sight and arthritis made the Kindle an almost must-have. This was so much ignored by other vendors (Apple included) that by the time other ebook stores launched, nobody else has made a dent in electronic book distribution. By ensuring that the Kindle App is available for nearly every platform, Amazon has gotten a choke-hold on electronic book distribution that's only starting to be realized at this point.

Someone told me a little bit back that Amazon's S3 services were priced at below cost at launch. Basically, they bet that they could drive costs down a bit, and that customers would see the move to their cloud services as a no-brainer at those prices and thereby gain them further economies of scale. At this point, I've run into lots of companies that have based their businesses on S3, but comparatively few who've done so on Google's AppEngine infrastructure AppEngine is a bit of a red-headed stepchild at Google because it can't be priced to produce high margins, while Amazon's very much used to low margins.

Obviously, business strategy is of no use if you screw up your execution strategy (or if your product sucks --- nothing ever saves you then), but ideally you want everything in place. Amazon's been the stealth surprise in the past few years in places that looked completely unrelated to e-commerce because of this. At the same time, Microsoft's not being doing so well at execution but its business strategy successes are being ignored by the press, and I think that counting them out would be a mistake.

Sep 27, 2011 (4 days ago)

Quote For The Day

"In prison, every time we complained about our conditions, the guards would immediately remind us of comparable conditions at Guantanamo Bay," - Shane Bauer, one of the two American hikers released last week after 781 days of detention in Iranian prison.

Sep 28, 2011 (3 days ago)

Which Telecoms Store Your Data the Longest? Secret Memo Tells All

The nation’s major mobile-phone providers are keeping a treasure trove of sensitive data on their customers, according to newly-released Justice Department internal memo that for the first time reveals the data retention policies of America’s largest telecoms.

The single-page Department of Justice document, “Retention Periods of Major Cellular Service Providers,” (.pdf) is a guide for law enforcement agencies looking to get information — like customer IP addresses, call logs, text messages and web surfing habits – out of U.S. telecom companies, including AT&T, Sprint, T-Mobile and Verizon.

The single-page Department of Justice document, “Retention Periods of Major Cellular Service Providers,” (.pdf) is a guide for law enforcement agencies looking to get information — like customer IP addresses, call logs, text messages and web surfing habits – out of U.S. telecom companies, including AT&T, Sprint, T-Mobile and Verizon.The document, marked “Law Enforcement Use Only” and dated August 2010, illustrates there are some significant differences in how long carriers retain your data.

Verizon, for example, keeps a list of everyone you’ve exchanged text messages with for the past year, according to the document. But T-Mobile stores the same data up to five years. It’s 18 months for Sprint, and seven years for AT&T.

That makes Verizon appear to have the most privacy-friendly policy. Except that Verizon is alone in retaining the actual contents of text messages. It allegedly stores the messages for five days, while T-Mobile, AT&T, and Sprint don’t store them at all.

The document was unearthed by the American Civil Liberties Union of North Carolina via a Freedom of Information Act claim. (After the group gave a copy to Wired.com, we also discovered it in two other places on the internet by searching its title.)

“People who are upset that Facebook is storing all their information should be really concerned that their cell phone is tracking them everywhere they’ve been,” said Catherine Crump, an ACLU staff attorney. “The government has this information because it wants to engage in surveillance.”

The biggest difference in retention surrounds so-called cell-site data. That is information detailing a phone’s movement history via its connections to mobile phone towers while its traveling.

Verizon keeps that data on a one-year rolling basis; T-Mobile for “a year or more;” Sprint up to two years, and AT&T indefinitely, from July 2008.

The document also includes retention policies for Nextel and Virgin Mobile. They have folded into the Sprint network.

The document release comes two months before the Supreme Court hears a case testing the government’s argument that it may use GPS devices to monitor a suspect’s every movement without a warrant. And the disclosure comes a month ahead of the 25th anniversary of the Electronic Privacy Communications Act, an outdated law that the government often invokes against targets to obtain, without a warrant, the data the Justice Department document describes.

“I don’t think there there is anything on this list the government would concede requires a warrant,” said Kevin Bankston, a staff attorney with the Electronic Frontier Foundation. “This brings cellular retention practices out of the shadows, so we can have a rational discussion about how the law needs to be changed when it comes to the privacy of our records.”

Sen. Patrick Leahy (D-Vermont) has proposed legislation to alter the Electronic Privacy Communications Act to protect Americans from warrantless intrusions. Debate on the issue is expected to heat up as the anniversary nears, and the Justice Department document likely will take center stage.

Infographics: Michael Cerwonka/Wired.com. Cell tower photo courtesy Locomotive8/Flickr

See Also:

- Google+ vs. Facebook on Privacy: + Ahead On Points — For Now

- Senator Wants Investigation of OnStar’s ‘Brazen’ Privacy Invasion

- Report: Facebook CEO Mark Zuckerberg Doesn’t Believe In Privacy

- DuckDuckGo Challenges Google on Privacy (With a Billboard)

- Insurance Company Telematics Trade Perks for Privacy

- Plug-Ins for Privacy: Redirect Remover and Trackerblock

Sep 27, 2011 (4 days ago)

For women, coffee can keep blues away

Sep 27, 2011 (4 days ago)

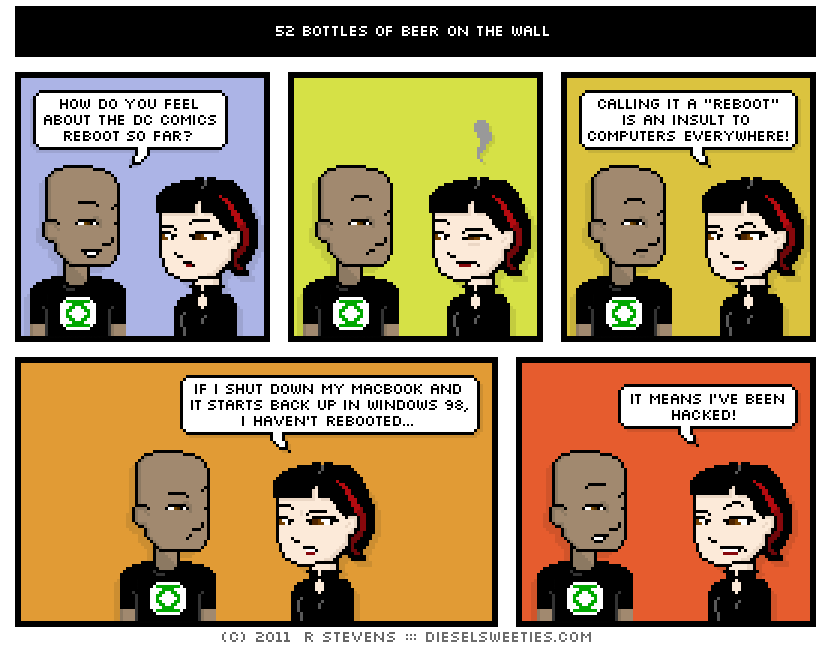

52 Bottles of Beer on the Wall

Pale Suzie does not like change. Ever.

Fun Fact: I was born on Planet Lunch and rocketed to Earth as an infant only to discover I had a Super-Appetite!

Sep 30, 2011 (20 hours ago)

Madden 12 Free to Download for Verizon Customers This Weekened

Have a hankering for mobile Madden but don’t want to pay for it? Verizon and the NFL are offering the game free of charge for the entire weekend (October 1st through 3rd). The game is usually $7 so you’ll be saving a pretty collection of pennies. No strings, no catches – just football. [via AndroidForums.com, Thanks Earl!]

Sep 27, 2011 (4 days ago)

A 7-year-old girl responds to DC Comics' sexed-up reboot of Starfire [Comics]

Fantasy author Michele Lee has the most eloquent response so far to DC Comics' "sexed up" version of Starfire, the voluptuous alien member of the Teen Titans. Instead of ranting about the changes herself, Lee asked her seven-year-old daughter what she thought. The results are thought-provoking. More »

Sep 27, 2011 (4 days ago)

America, popularity, good grades

Last week Azer and I were talking about how we should invest our money. Cash? Gold? Stocks?

One crux of this decision is how the American economy will fare. Azer's view was that America is no longer the land of innovation that it once was, except in high tech.

I am more optimistic about America. But the only thing that makes me more bearish is the way that America denigrates intelligence and studying. It's taken for granted that in America, there is mutual exclusion between being well-liked growing up and having very academic hobbies. The captain of the chess team is assumed to have trouble getting dates. If you are in high school and win lots of math competitions, people assume you're below average in admiration by peers.

In China, getting good grades makes you MORE popular. The valedictorian is usually very popular. And respected. It automatically gets you points. In America, it automatically drags you down in the eyes of your peers.

I think this is the single biggest factor that could lead to America's decline. Everyone wants to be loved and respected by their peers. Making that at odds with pursuing intellectual activities is very damaging to maintaining the status as the land of innovation.

One crux of this decision is how the American economy will fare. Azer's view was that America is no longer the land of innovation that it once was, except in high tech.

I am more optimistic about America. But the only thing that makes me more bearish is the way that America denigrates intelligence and studying. It's taken for granted that in America, there is mutual exclusion between being well-liked growing up and having very academic hobbies. The captain of the chess team is assumed to have trouble getting dates. If you are in high school and win lots of math competitions, people assume you're below average in admiration by peers.

In China, getting good grades makes you MORE popular. The valedictorian is usually very popular. And respected. It automatically gets you points. In America, it automatically drags you down in the eyes of your peers.

I think this is the single biggest factor that could lead to America's decline. Everyone wants to be loved and respected by their peers. Making that at odds with pursuing intellectual activities is very damaging to maintaining the status as the land of innovation.

Sep 28, 2011 (3 days ago)

Chicago is America's Most Mustache-Friendly City

Chicago is known for its affinity for men with mustaches and the American Mustache Institute has honored the City of Big Whiskers by naming Chicago "America's Most Mustache-Friendly City." [ more › ]

Chicago is known for its affinity for men with mustaches and the American Mustache Institute has honored the City of Big Whiskers by naming Chicago "America's Most Mustache-Friendly City." [ more › ]

Sep 27, 2011 (4 days ago)

How to get 2 free months of Hulu Plus

- Click here and enter your email address to receive one free month of Hulu Plus via Roku

- go to the Hulu Facebook page

- connect your Hulu and Facebook accounts (you can set it so that updates are sent only to you)

- check your email; a link will be sent to you that adds a second free month of Hulu Plus

- on your Hulu Plus account page, you'll see a billing date two months from the date of activation

Sep 28, 2011 (3 days ago)

Samsung doesn’t copy Apple

Samsung doesn’t copy Apple. Except for in-store iconography. And USB power adapters. And packaging. And dock connectors. And voice recording apps. And so on…

Source: Reddit via Daring Fireball

Sep 27, 2011 (4 days ago)

Apple Issues Invitations for October 4th iPhone Media Event

Confirming earlier reports, Apple today issued media invitations for a special iPhone event to be held next Tuesday, October 4th at the company's Town Hall auditorium at its headquarters in Cupertino, California. The event is scheduled to begin at 10:00 AM Pacific Time.

As noted by The Loop, invitations for the event carry the tagline "Let's talk iPhone" and depict iOS icons for Calendar, Clock, Maps, and Phone.

Apple is of course widely expected to introduce its next-generation hardware (whether it be iPhone 4S, iPhone 5, or both) at the event, and is expected to also be including a minor update to its iPod line. iOS 5 and iCloud are also expected to be topics of discussion at the event, while other reports have indicated that Facebook may launch its iPad app at the event.

Recent Mac and iOS Blog Stories

• Apple Gains Control of iCloudiPhone.com Domain Name [Updated x2]

• Apple's Q4 2011 Financial Results on October 18th, 2011

• Page 2: Facebook Integration into iOS 5?

• SFPD Internal Investigation Over Lost iPhone 5 Continues

• Apple Working on Curved-Glass iOS Devices for First Half of Next Year?

As noted by The Loop, invitations for the event carry the tagline "Let's talk iPhone" and depict iOS icons for Calendar, Clock, Maps, and Phone.

Apple is of course widely expected to introduce its next-generation hardware (whether it be iPhone 4S, iPhone 5, or both) at the event, and is expected to also be including a minor update to its iPod line. iOS 5 and iCloud are also expected to be topics of discussion at the event, while other reports have indicated that Facebook may launch its iPad app at the event.

Recent Mac and iOS Blog Stories

• Apple Gains Control of iCloudiPhone.com Domain Name [Updated x2]

• Apple's Q4 2011 Financial Results on October 18th, 2011

• Page 2: Facebook Integration into iOS 5?

• SFPD Internal Investigation Over Lost iPhone 5 Continues

• Apple Working on Curved-Glass iOS Devices for First Half of Next Year?

Sep 29, 2011 (2 days ago)

It’s Man vs. Machine and Man Is Losing

In the man-versus-machine competition, machine is winning. And it’s not just Watson beating humans on “Jeopardy.”

Since the recession ended, businesses had increased their real spending on equipment and software by a strong 26%, while they have added almost nothing to their payrolls.

In August, new orders and shipments of “capex goods” — defined as nondefense capital goods excluding aircraft — increased by 1.1% and 2.8%, respectively. In the same month, private payrolls (adjusted for the Verizon strike) edged up a mere 62,000.

For all the talk of uncertainty, the increase in orders is a sign that companies are optimistic about the future. After all, no executive would expand production facilities if he or she thought customer demand was about to stagnate.

In addition, the gain in shipments — up by nearly a 19% annual rate so far this quarter — suggests at least a modest gain in gross domestic product. After the shipment numbers were released, economists at J.P. Morgan raised their estimate for third-quarter real GDP growth to 1.5% from a previous 1.0%.

You can’t fault companies for investing in new machinery rather than hiring new workers. As two news reports detail, labor costs are rising, a function of both private and public pressures.

First, employers face a jump in health insurance costs. The Kaiser Family Foundation reported a 9% average increase in the premiums paid by employers this year. The average yearly cost to cover a family hit a record $15,073, up sharply from $13,770 in 2010.

Second, companies must deal with higher taxes to replenish state unemployment-benefit coffers. According to Wednesday’s Wall Street Journal, employers will get hit by higher tax bills as many states have to pay back Washington for benefit money borrowed during the recession.

In comparison to these rising labor bills, the wholesale cost of capital goods is up 1.6% over the past year.

The man-vs-machine situation, however, presents a huge negative to the outlook. In an economy based on consumer spending, the lack of jobs and income growth means consumers can’t spend.

Businesses’ preference for equipment — while understandable from a cost perspective — is also a big reason why policymakers are stymied to find ways to ignite job creation.

Indeed, the Federal Reserve‘s pursuit of low interest rates only widens the cost gap. That’s because it cheapens the borrowing costs for capital projects while doing little to hold down payroll expenses.

In August, new orders and shipments of “capex goods” — defined as nondefense capital goods excluding aircraft — increased by 1.1% and 2.8%, respectively. In the same month, private payrolls (adjusted for the Verizon strike) edged up a mere 62,000.

For all the talk of uncertainty, the increase in orders is a sign that companies are optimistic about the future. After all, no executive would expand production facilities if he or she thought customer demand was about to stagnate.

In addition, the gain in shipments — up by nearly a 19% annual rate so far this quarter — suggests at least a modest gain in gross domestic product. After the shipment numbers were released, economists at J.P. Morgan raised their estimate for third-quarter real GDP growth to 1.5% from a previous 1.0%.

You can’t fault companies for investing in new machinery rather than hiring new workers. As two news reports detail, labor costs are rising, a function of both private and public pressures.

First, employers face a jump in health insurance costs. The Kaiser Family Foundation reported a 9% average increase in the premiums paid by employers this year. The average yearly cost to cover a family hit a record $15,073, up sharply from $13,770 in 2010.

Second, companies must deal with higher taxes to replenish state unemployment-benefit coffers. According to Wednesday’s Wall Street Journal, employers will get hit by higher tax bills as many states have to pay back Washington for benefit money borrowed during the recession.

In comparison to these rising labor bills, the wholesale cost of capital goods is up 1.6% over the past year.

The man-vs-machine situation, however, presents a huge negative to the outlook. In an economy based on consumer spending, the lack of jobs and income growth means consumers can’t spend.

Businesses’ preference for equipment — while understandable from a cost perspective — is also a big reason why policymakers are stymied to find ways to ignite job creation.

Indeed, the Federal Reserve‘s pursuit of low interest rates only widens the cost gap. That’s because it cheapens the borrowing costs for capital projects while doing little to hold down payroll expenses.

Sep 29, 2011 (2 days ago)

Always Leave a Note

And That’s Why You Always Watch Critically Acclaimed Television Shows

And That’s Why You Always Watch Critically Acclaimed Television ShowsThe best way to learn a lesson is not to know you’re learning one.

Like, say, back in the early 2000s, right? I heard about all sorts of little shows that would just come and go, and I’d think “Oh, well, can’t have been that important.” But then, one day, I found this really amazing show, wow, it just had EVERYBODY on it, and they were all so well used! And by the end of the first season, I was just hooked, but then I heard it was getting low ratings, but hey, it was coming back! So I figured surely it was just the timeslot and the second season would hook everybody… GET IT???

Okay, well, maybe that was too subtle. But that second season, man! It was full of pop culture jokes, and really smart ones that weren’t always obvious! And about halfway in, I was SURE this show would last forever. But then, near the end, the network cut the order! And I was distraught!

So I worked all summer to get internet petitions signed and held viewing parties for reruns and got psyched! I was gonna DO THIS! I was gonna SAVE MY SHOW! And then, somehow, it didn’t work out. The show just ended. I didn’t even get a movie. And I was sitting all alone on a park bench crying when the head of the local Firefly fan club ran up, slapped me in the face with a fake arm, and yelled “AND THAT’S WHY YOU ALWAYS WATCH SHOWS WHEN OTHER PEOPLE ASK FOR YOUR HELP!”

And ever since then, my twenty six televisions have been running non-stop.

Wear this shirt: to know which way the wind blows. See? Now you can make the never-nude joke on your own!

Don’t wear this shirt: in a size too small, around your cousin. It might cause unhealthy thoughts.

This shirt tells the world: “Come ON!”

We call this color: Olive Made A Huge Mistake

Design Size:

3X – S: 7.00” x 8.38”

WXL - K4: 5.25” x 6.29”

Pantone Color(s): 100C

Please check our sizing chart before you order. The Woot Tee follows a classic closer-fitting style. If you prefer a baggier look, order a larger size. If there is not a larger size, consider starting a belly-hanging-out trend.

Sep 29, 2011 (2 days ago)

Samsung is not copying Apple, here is the proof

This is a fairly amusing collection of images that show the similarities between the Samsung Galaxy products and the Apple iPad and iPhone. There seem to be a lot of ways that the design of the two companies gadgets are overlapping. This is a bit of an issue as the Apple products arrived on the market first.

You may recognize the first image from a Samsung store that was using Apple’s app icons. Samsung later responded that it was removing the icons from its display. This compilation was put together by a Redditor who apparently saw some similarities.

The similarities between these products are being debated worldwide in over 20 cases dealing with both patents and industrial design. In the appeal of the injunction granted Apple against Samsung in Germany, Judge Brueckner-Hofmann, of the Dusseldorf Higher Regional Court had this to say about the comparison:

So how different do Samsung’s products have to be before they are no longer under scrutiny? I think that Sony’s tablets are a good example.

You may recognize the first image from a Samsung store that was using Apple’s app icons. Samsung later responded that it was removing the icons from its display. This compilation was put together by a Redditor who apparently saw some similarities.

The similarities between these products are being debated worldwide in over 20 cases dealing with both patents and industrial design. In the appeal of the injunction granted Apple against Samsung in Germany, Judge Brueckner-Hofmann, of the Dusseldorf Higher Regional Court had this to say about the comparison:

The court is of the opinion that Apple’s minimalistic design isn’t the only technical solution to make a tablet computer, other designs are possible. For the informed customer there remains the predominant overall impression that the device looks [like the design Apple has protected in Europe].Regardless of which side you take in the ongoing battle, it does raise some interesting questions about just how different these designs have to be. The iPad may feel like it was an inevitable product now, but before the iPad, tablets looked and worked significantly different.

So how different do Samsung’s products have to be before they are no longer under scrutiny? I think that Sony’s tablets are a good example.

Sep 27, 2011 (4 days ago)

Episode 628: On A Roll

Sometimes the fate of the world or the universe really does come down to a single die roll.

There's a philosophical argument to be had here. Should you let the fate of an entire game world be decided by something so random and fickle as the roll of a polyhedral lump of plastic (or other material, depending on how expensive your taste in dice runs).

The answer? Of course you should!

There's a philosophical argument to be had here. Should you let the fate of an entire game world be decided by something so random and fickle as the roll of a polyhedral lump of plastic (or other material, depending on how expensive your taste in dice runs).

The answer? Of course you should!

Sep 29, 2011 (2 days ago)

Kasey Keller likeness designed into five-acre corn maze

Photo credit: Courtesy of Sounders FC

Photo credit: Courtesy of Sounders FCWords can't do justice to this one, so I'll rely on the picture above to do the heavy lifting.

In short, Sounders FC goalkeeper Kasey Keller has been turned into a corn maze.

You can go check it out for yourself at the Schilter Family Farm in Olympia (141 Nisqually Cutoff Road SE). The "exhibit" will be open from 10 a.m. to 6 p.m. daily from Oct. 1-31.

Admission is $5 on weekdays and $10 on weekends; ages 2 and under are free.

The price covers access to the corn maze (which includes Keller trivia), the petting farm, hayrides, corn and pumpkin cannons, "round up railway" cow train, hay maze, a hay jump in a 140-year-old barn and other activities.

"It's certainly a unique tribute and very fitting given this is my hometown and my family has known the Schilter family for years and years," said Keller in a news release. "I honestly don't think too many other athletes can say they've had their likeness featured in a corn maze, and that is what makes it really cool to me. I hope a lot of fans can make their way to Olympia and enjoy it."

Sep 29, 2011 (2 days ago)

Why Is The US Government Still Collecting Taxes, Ctd

I am not really sure how meetings with the President go. When I see pictures of the Oval Office I wonder how anything gets done. There is some old wooden desk and what looks like couches.

There is no smart board, there are no computer screens, no interactive podiums. I wonder why don’t they just draw out battle plans with sticks in the sand and be done with it.

Anyway, since I assume the only graphics available are those that are printed out and handed to everyone, here is something they might want to pass around the prayer circle.

This is the estimated real cost of financing the US government over ten years. Its quickly approaching zero.

And, so I ask – Why is the US government still collecting taxes?

I mean seriously. What is it that you hope to accomplish by collecting taxes. One, might say to finance government expenditures, however, they can be financed for free in the bond market.

Lets just forget about stimulus. How about the simple fact that people don’t like to pay taxes. Here is the perfect opportunity to put this off until the future at very low cost. Why not do it?

Why not?

Filed under: Economics

There is no smart board, there are no computer screens, no interactive podiums. I wonder why don’t they just draw out battle plans with sticks in the sand and be done with it.

Anyway, since I assume the only graphics available are those that are printed out and handed to everyone, here is something they might want to pass around the prayer circle.

This is the estimated real cost of financing the US government over ten years. Its quickly approaching zero.

And, so I ask – Why is the US government still collecting taxes?

I mean seriously. What is it that you hope to accomplish by collecting taxes. One, might say to finance government expenditures, however, they can be financed for free in the bond market.

Lets just forget about stimulus. How about the simple fact that people don’t like to pay taxes. Here is the perfect opportunity to put this off until the future at very low cost. Why not do it?

Why not?

Filed under: Economics

Sep 29, 2011 (2 days ago)

Battlefield 3 Beta

Go download it now!

Content: Battlefield 3 Beta

Content: Battlefield 3 Beta

Price: Free

Availability: Check availability in your Xbox LIVE region

Dash Text: Join the Battlefield 3 Open Beta! Grab a few friends and jump into the Operation Métro map in Rush mode. Be sure to check out the integrated Battlelog features and share your thoughts on the Open Beta at battlelog.battlefield.com /The BF3 team at DICE

Add Battlefield 3 Beta your Xbox 360 download queue

Pre-Order Battlefield 3

Content: Battlefield 3 Beta

Content: Battlefield 3 Beta Price: Free

Availability: Check availability in your Xbox LIVE region

Dash Text: Join the Battlefield 3 Open Beta! Grab a few friends and jump into the Operation Métro map in Rush mode. Be sure to check out the integrated Battlelog features and share your thoughts on the Open Beta at battlelog.battlefield.com /The BF3 team at DICE

Add Battlefield 3 Beta your Xbox 360 download queue

Pre-Order Battlefield 3

Sep 28, 2011 (3 days ago)

About.com Identifies the Three Mindsets of Search

Why do people search online? According to a survey commissioned by About.com, they do it for one of three reasons. They want answers, they want to be educated or they want to be inspired.

Answer Me, is all about finding a quick solution to a problem or that little detail that’s niggling at your brain. “How do I get a broken light bulb out of the socket” to “who is that actor I just saw on TV?” Quick, doesn’t always equal urgent, but the searcher still doesn’t want to spend a lot of time on this. About says marketers can capitalize on these types of searches by presenting ads with clear benefits. “Smudge-proof” mascara, “dinner in under 10 minutes” or an exercise DVD that will help you “lose 10 pounds in 10 days.”

Educate Me is the longer route. These people are willing to put in the time if they come away smarter in the end. Health and finance are top topics for these searchers. They want information and the more detailed the better. About says marketers can capitalize on these folks by providing informative ads that tackle a topic from a variety of angles. For example, a company selling organic foods might present an ad that allows searchers to follow the food from farm to table, with detours that talk about the health, safety and economic factors.

Inspire Me folks have some time to kill and they want to be transported to another place. Travel and home are popular topics, but they might also be browsing through books and movies, discovering new images or playing a game. For this searcher, it’s all about creativity and a world of possibilities. To hook these surfers, marketers need to present something that captures the imagination. It could be images of an ice hotel or a video trailer for a new book.

The “Educate Me” folks do value the input of experts but they’re also willing to learn from their online friends and followers.

For those free-spirited “Inspire Me” searchers, there are no experts. They take their cues from their friends and social networks.

When asked about brands as experts, the results were very positive. 64% said ads helped them find great options or deals. 86% said they notice and enjoy brands that stop trying to sell in favor of teaching something useful.

Answer. Educate. Inspire.

It’s time to take a look at your ads to see where you fit in.

Answer Me, is all about finding a quick solution to a problem or that little detail that’s niggling at your brain. “How do I get a broken light bulb out of the socket” to “who is that actor I just saw on TV?” Quick, doesn’t always equal urgent, but the searcher still doesn’t want to spend a lot of time on this. About says marketers can capitalize on these types of searches by presenting ads with clear benefits. “Smudge-proof” mascara, “dinner in under 10 minutes” or an exercise DVD that will help you “lose 10 pounds in 10 days.”

Educate Me is the longer route. These people are willing to put in the time if they come away smarter in the end. Health and finance are top topics for these searchers. They want information and the more detailed the better. About says marketers can capitalize on these folks by providing informative ads that tackle a topic from a variety of angles. For example, a company selling organic foods might present an ad that allows searchers to follow the food from farm to table, with detours that talk about the health, safety and economic factors.

Inspire Me folks have some time to kill and they want to be transported to another place. Travel and home are popular topics, but they might also be browsing through books and movies, discovering new images or playing a game. For this searcher, it’s all about creativity and a world of possibilities. To hook these surfers, marketers need to present something that captures the imagination. It could be images of an ice hotel or a video trailer for a new book.

Who You Gonna Call?

Now here’s where things really get interesting. If you want answers, it’s logical that you’d want to talk to an expert, but About says it isn’t so. People in “Answer Me” mode said that finding an expert isn’t very important. They simply want a solution that works and they don’t care if it came from a doctor, home improvement specialist or an unknown stranger on a Q&A site.The “Educate Me” folks do value the input of experts but they’re also willing to learn from their online friends and followers.

For those free-spirited “Inspire Me” searchers, there are no experts. They take their cues from their friends and social networks.

When asked about brands as experts, the results were very positive. 64% said ads helped them find great options or deals. 86% said they notice and enjoy brands that stop trying to sell in favor of teaching something useful.

Answer. Educate. Inspire.

It’s time to take a look at your ads to see where you fit in.

Sep 30, 2011 (15 hours ago)

Google improves Analytics with premium and real-time features

Google on Thursday finally launched real-time traffic tracking tools for its already-good Google Analytics service. On top of that, the company introduced premium Google Analytics accounts that offer more ways measure data.

For quite some time, Google Analytics has offered webmasters a free way to measure traffic of their sites 24 hours after the action occurs. But since real-time traffic startups like Chartbeat (a service we use) and Woopra came onto the scene, Google Analytics has looked slow in comparison. Thankfully, that’s remedied with these new stats tools, which include social media impact and campaign measurement.

The company said its real-time stats are only available in the newest version of Google Analytics, so you’ll have to click the “New Version” link in the top right corner to get started. After that, you can read real-time reports by going into the Dashboards tab.

Google used the Analytics spotlight to launch more feature-rich Premium accounts targeted at its largest customers. In the pilot phase, Google coordinated with the likes of Gucci, Travelocity and eHarmony to collect feedback.

Google lists the following new features for Premium accounts:

• Extra processing power – increased data collection, more custom variables and downloadable, unsampled reportsGoogle did not list the fee it charges for the Premium service, but it said the fee was annual for users in the U.S., Canada and the U.K.

• Advanced analysis – attribution modeling tools that allow you to test different models for assigning credit to conversions

• Service and support – experts to guide customized installation, and dedicated account management on call – all backed by 24/7 support

• Guarantees – service level agreements for data collection, processing and reporting

A video introduction to Google Analytics Premium can be viewed below:

Filed under: cloud, enterprise

Sep 29, 2011 (2 days ago)

Reliving The Final Day in the AL, Visually

Below, you will find a graph detailing the probabilities that the Rays or the Red Sox would represent the American League as the Wild Card as the wild night of September 28th, 2011 progressed, based on Win Probability. Although we could never truly quantify whatever it was that happened yesterday, let these numbers be a handy guide as we highlight 16 of the key moments (with video links when possible) that ultimately resulted in the craziest night — and the craziest five minutes — in my baseball life and probably in baseball history.

Odds are calculated assuming a 50% win probability in a one-game playoff.

Click to embiggen as we dive into the night that was.

A. 7:48 PM. Dustin Pedroia hits an RBI single to give the Red Sox a 1-0 lead and a WP of 70%. The Rays remain tied at zero in the top of the second, but the Yankees are rallying, loading the bases with two outs, giving the Rays a WP of 30%.

Overall Odds: Boston 70%, Tampa Bay 30%.

B. 7:51 PM. Mark Teixiera clears the aforementioned loaded bases with a grand slam, giving the Yankees a 5-0 lead and leaving the Rays a WP of 10%. The Red Sox fail to score again in their half of the third, as David Ortiz grounds into a double play and Ryan Lavarnway strikes out, but the Sox hold a solid WP of 60% at this time.

Overall odds: Boston 75%, Tampa 25%.

C. 8:05 PM. J.J. Hardy homers (his 30th!) to give the Orioles a 2-1 lead and stick Boston with a WP of 37%. Still, the Red Sox appear headed for a tiebreaker with a loss at this point, as Tampa Bay still trails 4-0 in the bottom of the fourth, with a WP of 8%.

Overall odds: Boston 64%, Tampa Bay 36%

D. 8:33 PM. After Marco Scutaro scored on a balk in the fourth inning to tie the game, Dustin Pedroia homers off Alfedo Simon in the fifth to tie it and raise the Red Sox WP to 62%. Simon wouldn’t record another out. In St. Petersburg, the Rays have all of one hit through three innings and still trail 4-0, for a WP of 4%.

Overall odds: Boston 79%, Tampa 21%

E. 9:07 PM. Baltimore starts a rally in the sixth, as Jon Lester walks J.J. Hardy and Nick Markakis, giving Boston a win probability of 45%. Tampa Bay still can’t score.

Overall odds: Boston 72%, Tampa Bay 28%

F. 9:11 PM Vladimir Guerrero grounds into a double play. Threat over.

Overall odds: Boston 81%, Tampa Bay 19%

G. 9:30 PM. Rain delay in Boston with the score still 3-2 heading into the bottom of the seventh, for a 64% win probability. Tampa Bay’s efforts still prove futile, as the Rays trail 7-0 following homers from Mark Teixeira (again) and Andruw Jones. The Rays’ WP is down to 1%.

Overall odds: Boston 82%, Tampa Bay 18%

H. 10:22 PM. After Yankee wildness leads to the Rays’ first three runs in the eighth inning, Evan Longoria breathes life into the Rays with a three run home run off Luis Ayala to close the margin to 7-6. It’s a home run one could feel coming — the Rays’ announcer declares it a “moment Evan was made for” seconds before the crack of the bat. The Rays still have work to do, but winning the game is a possibility now, and they hold an 18% win probability as rain continues to fall in Baltimore.

Overall odds: Boston 70%, Tampa Bay 30%

I. 10:42 PM. The Great Pumpkin strikes again. Dan Johnson, known for his pinch-hit game-tying home run in 2008 off Johnathan Papelbon, hits another pinch-hit game-tying home run with two outs and two strikes in the bottom of the ninth off former Tampa Bay Ray Cory Wade to tie the game. As the tarp stays on in Baltimore, it’s a whole new game in Tampa Bay. The Rays fail to finish it in the 9th, carrying a 50% WP into extra frames with the score 7-7.

Overall odds: Boston 57%, Tampa Bay 43%

J. 10:58 PM. Play resumes in Boston, as Mark Reynolds is hit by an Alfredo Aceves pitch, lowering Boston’s WP to 56%. Meanwhile, the Rays are an out away from taking their turn in the 10th, and their WP sits at 60%, giving them their first “lead” of the night since 7:15 PM.

Overall odds: Tampa Bay 52%, Boston 48%

K. 11:17 PM. Johnny Damon strikes out against Scott Proctor, stranding B.J. Upton at first base as the Rays and Yankees head to the eleventh. The Sox head to the bottom of the eighth, holding on to a one-run lead and a 70% WP. The tide is back in Boston’s favor.

Overall odds: Boston 60%, Tampa Bay 40%

L. 11:38 PM. Brandon Guyer singles to left, giving the Rays runners on first and second with one out, a 70% WP. At Camden Yards, the Red Sox have runners on the corners with one out as they look for insurance runs in the top of the ninth, giving them a solid 89% WP. At this point, a playoff seems more likely than at any other point in the day (62%). Both Boston and Tampa Bay would fail to score in the ninth and eleventh respectively.

Overall odds: Boston 59%, Tampa Bay 41%

M. 11:51 PM. Boston approaches the victory, as Jonathan Papelbon records two quick strikeouts in the bottom of the ninth. With the bases empty and Chris Davis coming to the plate, the Red Sox hold a 95% win probability and look to force at least a one-game playoff. Meanwhile, Tampa Bay is in trouble at the trop, as the Yankees put runners on first and third with nobody out.

Overall odds: Boston 89%, Tampa Bay 11%

N. 11:55 PM. The worm turns. Jonathan Papelbon allows two straight doubles to the Orioles’ eight and nine hitters, Davis and Nolan Reimold, and the Orioles tie the game and have the winning run in scoring position, giving the Sox a 39% win probability, nearly equal to their total after the Hardy home run. At the Trop, the Rays escape as Jake McGee induces a grounder and and out at third thanks to a heads-up play by Evan Longoria and an awful baserunning mistake by Greg Golson. The Rays now have two out and only one on and a 52% WP, holding their best situation of the night.

Overall odds: Tampa Bay 56%, Boston 44%.

O. 12:00 AM. The Rays escape to the bottom of the 12th inning with the game still tied. The Red Sox are less lucky, as Robert Andino lines a ball into left field that slips in and out of Carl Crawford‘s glove and the Orioles walk off to finish Camden Yards’s season in style. The Red Sox must now hope the Rays, who own a 63% win probability, fall to the Yankees.

Overall odds: Tampa Bay 81%, Boston 19%.

P. 12:03 AM. As the fans in the Trop cheer the news of the Red Sox demise, Evan Longoria connects on a Scott Proctor fastball that seems to glide over the top of the left-field wall as it leaves the park. Never have the fates of a 162 game season have changed more over 10 minutes of game action. The Rays take the victory 8-7 and win the Wild Card with a 91-71 record.

Overall odds: Tampa Bay 100%, Boston 0%.

Odds are calculated assuming a 50% win probability in a one-game playoff.

Click to embiggen as we dive into the night that was.

A. 7:48 PM. Dustin Pedroia hits an RBI single to give the Red Sox a 1-0 lead and a WP of 70%. The Rays remain tied at zero in the top of the second, but the Yankees are rallying, loading the bases with two outs, giving the Rays a WP of 30%.

Overall Odds: Boston 70%, Tampa Bay 30%.

B. 7:51 PM. Mark Teixiera clears the aforementioned loaded bases with a grand slam, giving the Yankees a 5-0 lead and leaving the Rays a WP of 10%. The Red Sox fail to score again in their half of the third, as David Ortiz grounds into a double play and Ryan Lavarnway strikes out, but the Sox hold a solid WP of 60% at this time.

Overall odds: Boston 75%, Tampa 25%.

C. 8:05 PM. J.J. Hardy homers (his 30th!) to give the Orioles a 2-1 lead and stick Boston with a WP of 37%. Still, the Red Sox appear headed for a tiebreaker with a loss at this point, as Tampa Bay still trails 4-0 in the bottom of the fourth, with a WP of 8%.

Overall odds: Boston 64%, Tampa Bay 36%

D. 8:33 PM. After Marco Scutaro scored on a balk in the fourth inning to tie the game, Dustin Pedroia homers off Alfedo Simon in the fifth to tie it and raise the Red Sox WP to 62%. Simon wouldn’t record another out. In St. Petersburg, the Rays have all of one hit through three innings and still trail 4-0, for a WP of 4%.

Overall odds: Boston 79%, Tampa 21%

E. 9:07 PM. Baltimore starts a rally in the sixth, as Jon Lester walks J.J. Hardy and Nick Markakis, giving Boston a win probability of 45%. Tampa Bay still can’t score.

Overall odds: Boston 72%, Tampa Bay 28%

F. 9:11 PM Vladimir Guerrero grounds into a double play. Threat over.

Overall odds: Boston 81%, Tampa Bay 19%

G. 9:30 PM. Rain delay in Boston with the score still 3-2 heading into the bottom of the seventh, for a 64% win probability. Tampa Bay’s efforts still prove futile, as the Rays trail 7-0 following homers from Mark Teixeira (again) and Andruw Jones. The Rays’ WP is down to 1%.

Overall odds: Boston 82%, Tampa Bay 18%

H. 10:22 PM. After Yankee wildness leads to the Rays’ first three runs in the eighth inning, Evan Longoria breathes life into the Rays with a three run home run off Luis Ayala to close the margin to 7-6. It’s a home run one could feel coming — the Rays’ announcer declares it a “moment Evan was made for” seconds before the crack of the bat. The Rays still have work to do, but winning the game is a possibility now, and they hold an 18% win probability as rain continues to fall in Baltimore.

Overall odds: Boston 70%, Tampa Bay 30%

I. 10:42 PM. The Great Pumpkin strikes again. Dan Johnson, known for his pinch-hit game-tying home run in 2008 off Johnathan Papelbon, hits another pinch-hit game-tying home run with two outs and two strikes in the bottom of the ninth off former Tampa Bay Ray Cory Wade to tie the game. As the tarp stays on in Baltimore, it’s a whole new game in Tampa Bay. The Rays fail to finish it in the 9th, carrying a 50% WP into extra frames with the score 7-7.

Overall odds: Boston 57%, Tampa Bay 43%

J. 10:58 PM. Play resumes in Boston, as Mark Reynolds is hit by an Alfredo Aceves pitch, lowering Boston’s WP to 56%. Meanwhile, the Rays are an out away from taking their turn in the 10th, and their WP sits at 60%, giving them their first “lead” of the night since 7:15 PM.

Overall odds: Tampa Bay 52%, Boston 48%

K. 11:17 PM. Johnny Damon strikes out against Scott Proctor, stranding B.J. Upton at first base as the Rays and Yankees head to the eleventh. The Sox head to the bottom of the eighth, holding on to a one-run lead and a 70% WP. The tide is back in Boston’s favor.

Overall odds: Boston 60%, Tampa Bay 40%

L. 11:38 PM. Brandon Guyer singles to left, giving the Rays runners on first and second with one out, a 70% WP. At Camden Yards, the Red Sox have runners on the corners with one out as they look for insurance runs in the top of the ninth, giving them a solid 89% WP. At this point, a playoff seems more likely than at any other point in the day (62%). Both Boston and Tampa Bay would fail to score in the ninth and eleventh respectively.

Overall odds: Boston 59%, Tampa Bay 41%

M. 11:51 PM. Boston approaches the victory, as Jonathan Papelbon records two quick strikeouts in the bottom of the ninth. With the bases empty and Chris Davis coming to the plate, the Red Sox hold a 95% win probability and look to force at least a one-game playoff. Meanwhile, Tampa Bay is in trouble at the trop, as the Yankees put runners on first and third with nobody out.

Overall odds: Boston 89%, Tampa Bay 11%

N. 11:55 PM. The worm turns. Jonathan Papelbon allows two straight doubles to the Orioles’ eight and nine hitters, Davis and Nolan Reimold, and the Orioles tie the game and have the winning run in scoring position, giving the Sox a 39% win probability, nearly equal to their total after the Hardy home run. At the Trop, the Rays escape as Jake McGee induces a grounder and and out at third thanks to a heads-up play by Evan Longoria and an awful baserunning mistake by Greg Golson. The Rays now have two out and only one on and a 52% WP, holding their best situation of the night.

Overall odds: Tampa Bay 56%, Boston 44%.

O. 12:00 AM. The Rays escape to the bottom of the 12th inning with the game still tied. The Red Sox are less lucky, as Robert Andino lines a ball into left field that slips in and out of Carl Crawford‘s glove and the Orioles walk off to finish Camden Yards’s season in style. The Red Sox must now hope the Rays, who own a 63% win probability, fall to the Yankees.

Overall odds: Tampa Bay 81%, Boston 19%.

P. 12:03 AM. As the fans in the Trop cheer the news of the Red Sox demise, Evan Longoria connects on a Scott Proctor fastball that seems to glide over the top of the left-field wall as it leaves the park. Never have the fates of a 162 game season have changed more over 10 minutes of game action. The Rays take the victory 8-7 and win the Wild Card with a 91-71 record.

Overall odds: Tampa Bay 100%, Boston 0%.

Sep 30, 2011 (yesterday)

Step Aside BBC "Trader": Head Of UniCredit Securities Predicts Imminent End Of The Eurozone And A Global Financial Apocalypse

Either the YesMen have infiltrated Italy's biggest, and most undercapitalied, bank, or the stress of constant, repeated lying and prevarication has finally gotten to the very people who know their livelihoods hang by a thread, and the second the great ponzi is unwound their jobs, careers, and entire way of life will be gone. Such as the head of UniCredit global securities Attila Szalay-Berzeviczy, and former Chairman of the Hungarian stock exchange, who has written an unbelievable oped in the Hungarian portal Index.hu which, frankly, make Alessio "BBC Trader" Rastani's provocative speech seem like a bedtime story. Only this time one can't scapegoat Szalay-Berzeviczy "naivete" on inexperience or the desire to gain public prominence. If someone knows the truth, it is the guy at the top of UniCredit, which we expect to promptly trade limit down once we hit print. Among the stunning allegations (stunning in that an actual banker dares to tell the truth) are the following: "the euro is “practically dead” and Europe faces a financial earthquake from a Greek default"... “The euro is beyond rescue”... “The only remaining question is how many days the hopeless rearguard action of European governments and the European Central Bank can keep up Greece’s spirits.”...."A Greek default will trigger an immediate “magnitude 10” earthquake across Europe."..."Holders of Greek government bonds will have to write off their entire investment, the southern European nation will stop paying salaries and pensions and automated teller machines in the country will empty “within minutes.” In other words: welcome to the Apocalypse...

But wait, there's more. From Bloomberg:

Full op-ed from Index.hu, google translated from Hungarian. Some of the nuances may be lost, but the message is bolded. If any one our Hungarian-speaking readers have a better translation, please forward it to us asap.

Europe's common currency is virtually dead. The euro's doomed situation. The only open question now is, that European governments and the European Central Bank's desperate rearguard action even number of days to keep the spirit in Greece. For the moment, when Athens is declared bankrupt, a "10 magnitude" earthquake will shake Europe, which will be the overture to a whole new era in the life of the old continent.

Indeed, Greece is not only bankruptcy will mean that the Greek government securities holders did not get back their money invested, but also to the interior of the state will not be able to meet its debts.

From the moment only Greek teachers, doctors, police, army, ministry and local government employees will not receive a salary, just as the seniors did not expect nyugdíjukra good time. The ATM is emptied in minutes. The local banks are stuck holding government securities, an immediate liquidity crisis, devaluation of the Greek banking system in total collapse. Thus the savings of depositors is totally wasted because the Greek government deposit insurance or guarantee was now living. Bankkártyájukról since then, not only at home will not be able to withdraw some money, but the world's only automatájából not. The benzinkutakból run out of fuel, as well as food from the grocery store. Greece is practically a full stop at least a decade of life and dramatic drop in poverty in the country as a whole.

The problem is that in this case, the disaster can not stop at the Greek border, but great speed and momentum tovagy?r?z?dik then the entire euro zone, Europe, and finally shake the world. Channel for the spread of infection, of course, such a scenario would also back the banking system. Indeed, the international banks in Greece suffered hundreds of billions of euros t?kevesztésükön too soon be forced to lock hitelkereteit other banks, which will have to do with a country where - according to investors' expectations - the Greek thunderbolt strike again.

And when the banks no longer trust each other, not to lend to each other, the international financial markets stop. This in turn means that all financial institutions left alone with clients.

Poor countries with weak banks start to panic withdrawals of retail funds. But since the retail and corporate deposits and loans are allocated in the form of inter-bank market, these banks can not borrow bridging purposes, may be an immediate liquidity crisis. This is, to all financial institutions can be put into bankruptcy, which is stable and there is no capital behind strong, creditworthy countries. European countries are now, of course, guarantee the safety of their deposits, but the collapse of the banking system would be in financial straits due to the governments of the countries whose banking systems should extend under his arm. Thus, the escalating self-fulfilling panic söpörhet way through Europe, the euro zone which then leads to disintegration.

Of course, Angela Merkel, Nicolas Sarkozy and Jose Manuel Barroso repeated daily unos-untalan to disintegration of the euro zone there is no question of the euro remains in any case, as an alternative to this would be a huge cost to all Member States. But the currency union dissolution is probably one of the main features will be managed from Brussels, it is not a process but an uninvited guest arriving as a result of financial apocalypse. The euro area break-up, timing, strength of the human factors as well as money and capital market forces and trends will define the politicians was only with us panic watching the developments as three years ago was when Lehman Brothers collapsed.

The now four-year, and is constantly raging crisis in the greedy, selfish human nature too is certainly not the banks, not brokers, not the weather and no natural disasters, but above all, and especially at any price with economic growth, power libertine policy responsible for the global elite. Namely, those legislators, the majority of whom have never been able to see through the international financial developments, therefore, the corresponding pre-crisis legislation will only have been available, when in 2008 the world has collapsed.

However, the banks should be regulated, not criminalized or stigmatized.

The American politicians, at least it has always been understood that the money and capital markets are efficient economic policy allies of the investor for the company are responsible for. In contrast, their counterparts in Europe, unfortunately, still do not understand the nature of markets, most of them think that the financial system, the ancient enemy, because it does not work the way it is dictated by their own political interests.

Was a huge mistake and irresponsibility on the part of the political elite of the international crisis in 2009, the easing of its own negligence and error concealment of public passion in order to make a scapegoat of feltüzelésével from financial institutions. When everyone knows exactly that the taxpayers 'money to government banks are not rescued, but the corporate, retail and municipal depositors' money. This was not a political decision - like, say, airlines or car manufacturers for - but a serious system troubleshooting.

The two reasons people moved their money to the bank: I want to know it is safe and hope the interest on their savings. The bank has to create the security, interests, it must produce. It will only be able to do so, it assigns to the deposits in the form of credit to where money is needed for the operation, growth and job creation. It is sufficient interest to be collected by then to be able to pay interest to depositors.

Banks are so important to the economy, fuel carriers, which in times of crisis in the economies most vulnerable points, which therefore must be protected and safeguarded at all costs. Eventually, this belátva "after the rain the rain jacket," the way Europe was born in the EU capital adequacy directive, the United Kingdom, Vickers Commission's recommendation, the United States, the Dodd-Frank Act, while at the global level, the Basel Committee (Basel Committee on Banking Services) III. package. These are all one and all of the banking capital and liquidity position on increasing. The regulations, restrictions - which is no small effect on the Hungarian banking capital and liquidity position as well - but the price that banks in lending rates to curb forced a diminishing impact on economic growth and increase unemployment.

There is a country ...

However, there is still a country in Europe where the political elite in recent years not learning from the crisis of economic policy impasse will continue its adventures. A place where politicians continue to irresponsibly mantrázzák that banks are the source of every problem and an imaginary part of the economic Patriotic War must convince them, instead of strengthening their capital rohannának the upcoming Euro final before the onset of disaster. And is still seriously they think the country will benefit if long-term processes in the international market against marching.

This, unfortunately, no other country like Hungary, where governments, businesses and a significant proportion of the population indebted up to the neck, near the Swiss franc will spend his days. By now almost everyone's favorite topic of "what the devizahiteleseinkkel start" in the story, which is again due to the political elite of our society began to polarize. Despite the disagreement is not really suffering, and lack of solidarity between runs, but the solution and a further deterioration of the situation. Finally, the Government of a sudden, shocking everyone with lightning speed by dragging points in the debate. For many, the record speed in the parliament adopted legislation relevant music for the ears. I, however, the minority that the government of the country for the wrong, dangerous and immensely unjust solution.

Who is responsible for the credibility of the currency situation that has evolved?

To determine if this is not necessary to set up committees of inquiry. The situation that has evolved over the past decade, the whole Hungarian political elite is responsible for short-sighted and self-serving politizálásával the following four steps as a result of our country to benefit vulnerable position.

1) The spectacular public debt in 2000, started by the then Urban's government overspending as part of a drastic cut in home loan into a generous budget kamattámogatásába. This was the hope that in the 2002 elections will help the start-up in domestic demand growth path to make the country an international crisis in the middle. Eventually won the elections, Socialist Party of Free Democrats coalition that he is "hundred-day program," observed head (which was then in opposition Fidesz is automatically voted on) that some further policy steps complete with an amazing total indebtedness of the country. Both political side hoped that the expansion of domestic demand BOOST artificial, accelerated through the distributing political economy, that will then automatically produces a cover to hide the resulting deficits. However, this hypothesis was wrong, the more so because the supercharged domestic demand stimulated imports only, and this is only exploited by the country's trade balance. The resulting fiscal imbalance is a false illusion of wealth, causing catalyzed by the growing demand for consumer credit.

2) The Hungarian population is not the currency of their own band, not to loans after the country's deteriorating economic condition of the forint faced having to pay the interest rate premium. In the nine years of failed economic policy (unsustainable pension, health and housing subsidy system, beyond the minimum 50 percent increase for public servants carried out under 50 percent wage increase, a 19 thousand forints single pension supplement, the 13th month pension, the introduction of the minimum wage, tax exemptions make the reckless áfaváltoztatások, the state and the private sector, real or imagined, a partnership of PPP investments proliferation, unrealistically expensive highway construction), an abnormally low taxpayer morale, coupled with a growing hole in the state household, and this is the country's indebtedness resulted. A short well-being of our economy and substance of political change in direction instead of the current Hungarian Government to finance its foreign investors, who do all this, of course, the increased risks due to a high interest rate premium they would do next.

3) The current Hungarian government's fault that 21 years after the regime change in the financial and economic fundamentals are still not subject to the compulsory part of secondary school education and the maturity of. The reason people can not just lending a little, but have no idea what's the difference between the interest rate and the APR, there is no sufficient information about themselves on the bank, a financial trader. For this reason, then vulnerable, defenseless, non-savers are active, spend more strength above. What megtakarítanak yet, I want to keep it under his pillow, and averse from the Stock Exchange do not understand the fundamental economic relationships are not. So, of course, are highly susceptible to demagogic politicians banking and capital market, anti-rhetoric, when the situation rather than solutions themselves instead of trying to find those responsible.

4) The adóforintjainkból reserved for government and the financial market supervisory bodies to be surprised at the deepest crisis in his sleep in 2008. They were not able to perform a task, and therefore unprepared for the crisis in Hungary, it was more severe effect. The current government, parliament, central bank supervision and the responsibility to monitor, if necessary, regulate the market trends and anomalies if large or dangerous trends are seen, it is time to take action early - applying for the relevant law must drive everyone back on track. (For example, if a bank responsible wanted to act and therefore does not give franc loan to the customer, the customer response passed from another bank, which serve them.) Therefore, the Socialist-Free Democrats government enormous mistake when unleashed in Hungary in foreign currency lending, instead of restrictive legislation would have created that all banks are equally strong against the standards of the franc would have corroborated related lending. This of course does not dealt with the then opposition in parliament.

The government in the role of Don Quixote

The Hungarian government, the fiscal position to deal with a simple but populist solution. The problem with all of its declared banks began systematically stamping: the crisis in the banking system, taxes were imposed, a moratorium on the enforcement of mortgages, a three-year rate lock maximizing debtors' monthly repayments. These measures, of course, painful lives of all financial institutions, but also understandable and tolerable in view of the crisis. The government's latest idea, a stream of foreign exchange price fixed mortgage repayments, however, is beyond all the existing boundary of sanity.

The banks seem to be borne by the strokes well, because they are the eyes of external sources of unrestricted funds (but not their own money to the banks, the depositors and shareholders should have). But the reality is that domestic banks in these lépéssekkel lose their profit and a significant part of their capital, which puts a dangerous situation in the Hungarian banking system just when the world, the banks' capital and liquidity, strengthening the position of working with governments. The current situation at home, in response to the banks to curb lending further forced the mostly foreign-owned banks are a part of our opt for the departure. Of course, this last step we can say that this is who cares: just because it will improve under the leadership of the Hungarian financial institutions, market-making opportunity.

But the situation is far more complex. Firstly, the total size of Hungarian banks are not enough large to be financed only from domestic sources themselves the entire Hungarian economy. Second, any taxpayer suicide in terms of budget, job-creating companies elüldözni, especially when it leads to the purchase of Hungarian government securities. And last but not least, a shrinking national economy and increasingly risky financial institution operating in a responsible one is not increasing market shares. If it is the country where the bank is also home country, this means increase in the risk of increasingly sidelined in international financial markets and is also much more expensive than the current one, or none at all will not be able to involve funds from abroad.

Therefore, higher interest rates and forint dramatically in need of corporate and household lending in Hungary can be expected that we all have bad news. Especially when considering the lawfulness that each percentage point of economic growth should grow in the order of four percent each year, the bank's loan portfolio. Failing this, the road remains a continuing recession and rising unemployment direction. Same point in the past three years has shown that the unlimited and unregulated credit expansion is what can lead to trouble. But that is a credit to the economy in which the living body of water: an essential and irreplaceable. It is not to mention that the lack of competition in supply and rising bank costs, and declining service quality leads.

Long live the social implications

A favorable exchange rate for foreign currency loans, repayment options and money market of the real economic problems are a very important set of issues it raises: the action is extremely unfair to socially as well.

1) Take yourself, who adósodott not it?

We turn to a bank loan, because we decided against that and not because of this gun to force bank. A man with a credit consumer, who is living beyond its capabilities with real, or better living conditions than that you can afford. But this is not a problem per se, but only in private. Especially if the forint borrowing rather than foreign currency. The foreign debt is nothing more than speculation in the currency weakening. The borrower to receive foreign currency, the forint strengthened or will increase, so the repayments are lower, or even weaken, the depreciation rate will never exceed the forint and Swiss franc relative kamatkülönbözetb?l from profits. The customer decides the bank to credit the HUF will be required over 10 per cent interest or more on selected franc loan 6 percent. One man's debt burden is higher, but there is no exchange rate risk, while the other smaller interest burden, coupled with exchange rate risk. So the possibility of the borrower, risk tolerance in relation to the choice. Responsibility for the judgments of others do not sew the neck, once it did not work for what we expected. However, the government decided that the losses for the banks to take over. This means that if a crisis of financial institutions to the edge of collapse because of their capital szétporladó are, the Hungarian government, the taxpayers will have to set their feet so as not to lose there money to depositors, since they guarantee. That is simplistic: while the forint was strong, the currency authentic nyer?ben were, and when the partially self-constructed position weakened forint due to losses incurred when the government that tries them be required to pay, who did not want a loan, but instead saved a and deposit bankjuknál form affixed. Those who are indebted in HUF, are now beyond their own pain authentic solidarity even in the foreign exchange burden themselves may assume, therefore, double-pay. This is extremely unfair to those who lives without borrowing to the extent possible is held responsible, thinking the more expensive or forint loans was recorded, compared to a profit for many years a relatively foreign credit insurance.

The exchange of authentic reference that no one told them to such an extent, the forint weakened and discredited simply unacceptable. In addition, point in a country with a population over many decades, they were socialized to be the best foreign currency savings, as the forint has already been countless times leértékelve. Not to mention that the man, after long and careful consideration in choosing real estate. It is difficult to imagine that a funding condition can not inquire about the system thoroughly.

2) Support those who took the rose hill francs their apartment?